HPMSM

(High Purity Manganese Sulphate Monohydrate)

HPMSM is currently a small portion of the overall Manganese industry. Manganese has historically been used in the steel industry to produce alloys and to a much smaller degree has been used in foundries and welding. The steel industry used 90% of the manganese that was produced in 2020 and the remaining 10% was used for electrolytic manganese metal (EMM), electrolytic manganese dioxide (EMD) and manganese chemicals, particularly manganese sulphate. Manganese sulphate is the chemical used in fertilizers as well as in Manganese Lithium-Ion batteries. The Manganese sulphate used for fertilizers has a higher level of toxicity, and the Manganese sulphate used in batteries has a higher level of purity with limitations on battery active impurities. HPMSM is sometimes used to describe (Battery Grade) Manganese sulphate, but it is best described to have a higher purity than the standard battery-grade Manganese sulphate.

HPMSM demand has unparalleled growth potential as a raw material for the EV sector as well as the energy storage sector. HPMSM can be produced through two main processes which are dissolution of EMM and a chemical-based process that uses ore as a direct feedstock:

1. The production of HPMSM from the sulphuric acid dissolution of EMM/HPEMM requires increased electricity requirements in the processing method. However, there very few orebodies that contain suitable impurities to achieve the required battery grade quality without electrolysing the metal, such as manganese carbonate.

2. Chemical-based process often require specific orebodies that are less common and significantly fuel-intensive. Additionally, chemically produced HPMSM direct from ore often contains traces of fluorine ions, that can make it unsuitable for inclusion in nickel-manganese-cobalt (NMC) precursors for LIBs.

As of 2020, there were 12 independent plants in the world capable of producing HPMSM.

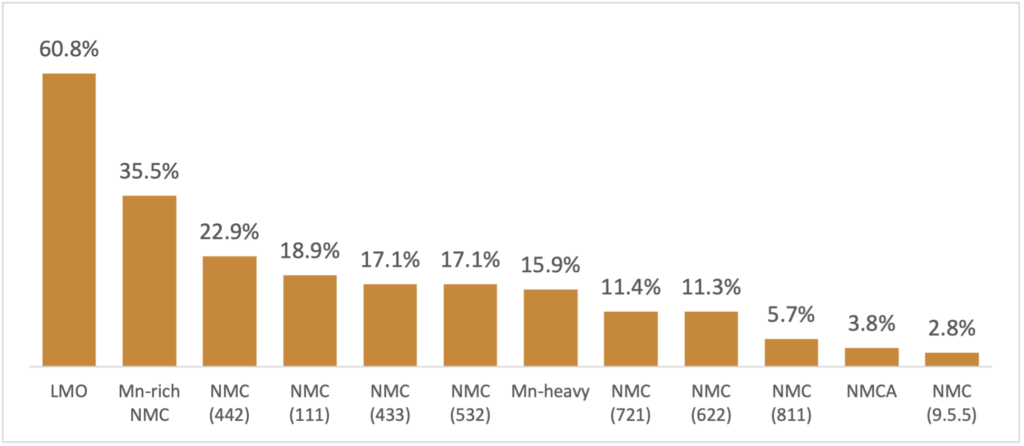

HPMSM demand growth is driven by the electric vehicle (“EV”) industry’s adoption of manganese-based lithium-ion batteries (“LIB”) cathode chemistry. Manganese is contained in the majority of the cathode chemistries used in EVs

Current EV Cathode Chemistries

LMFP: Lithium-Manganese-Iron-Phosphate

LFP: Lithium-Iron-Phosphate

LNMO: Lithium-Nickel-Manganese Oxide

LMO: Lithium-ion Manganese Oxide

NMCA: Nickel-Manganese-Cobalt-Aluminum

NMC: Nickel-Manganese-Cobalt

LMR: Lithium-Manganese Rich

NCA: Nickel-Cobalt-Aluminum

Manganese Content of Lithium-ion Battery Cathodes (metals mass – kg/kWh)