Woodstock Project

Property Overview

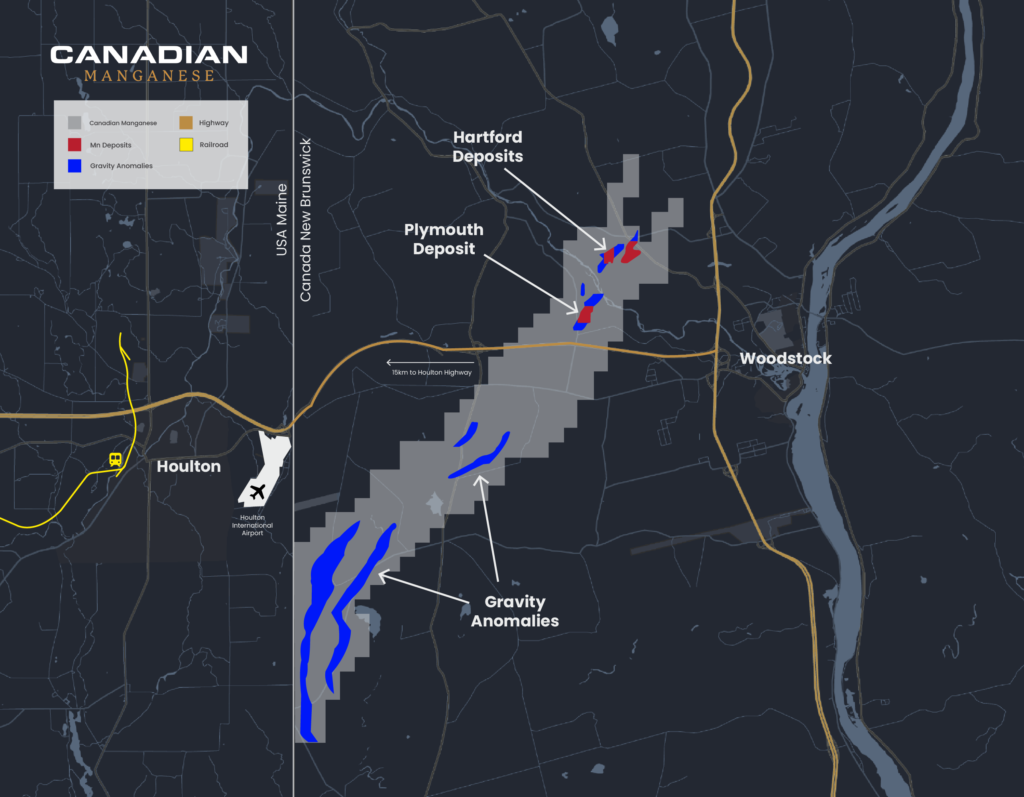

The Woodstock Project is located in western New Brunswick, Canada, approximately 5 km west of the town of Woodstock and 15 km east of the town of Houlton, Maine, USA. Comprised of Mineral Claim Number 5472, that contains 232 mineral claim units (5,875 ha), it includes the Plymouth Deposit and is 100% owned by CDMN. CDMN is also the owner of surface rights covering an area of 53 ha within Mineral Claim 5472 that cover a portion of the Plymouth Deposit.

The Woodstock Project is well positioned with respect to infrastructure. In addition to proximity to several towns and the provincial capital, a railway line is accessible in nearby Houlton, Maine and grid electrical power is readily accessible.

The extensive surface drainage systems present in the Saint John River watershed provide readily accessible potential water sources for incidental exploration use such as diamond drilling. They also provide good potential as higher volume sources of water such as those potentially required for future mining and milling operations.

Bryan Way, in his Master’s Thesis on the Woodstock area manganese occurrences, outlined that the area “hosts a series of banded iron formations that collectively constitute one of the largest manganese resources in North America, approximately 194,000,000 tonnes”.

CDMN’s Woodstock Project contains approximately 75% of these estimated tonnes, with significant additional growth potential identified.

Land Package Summary

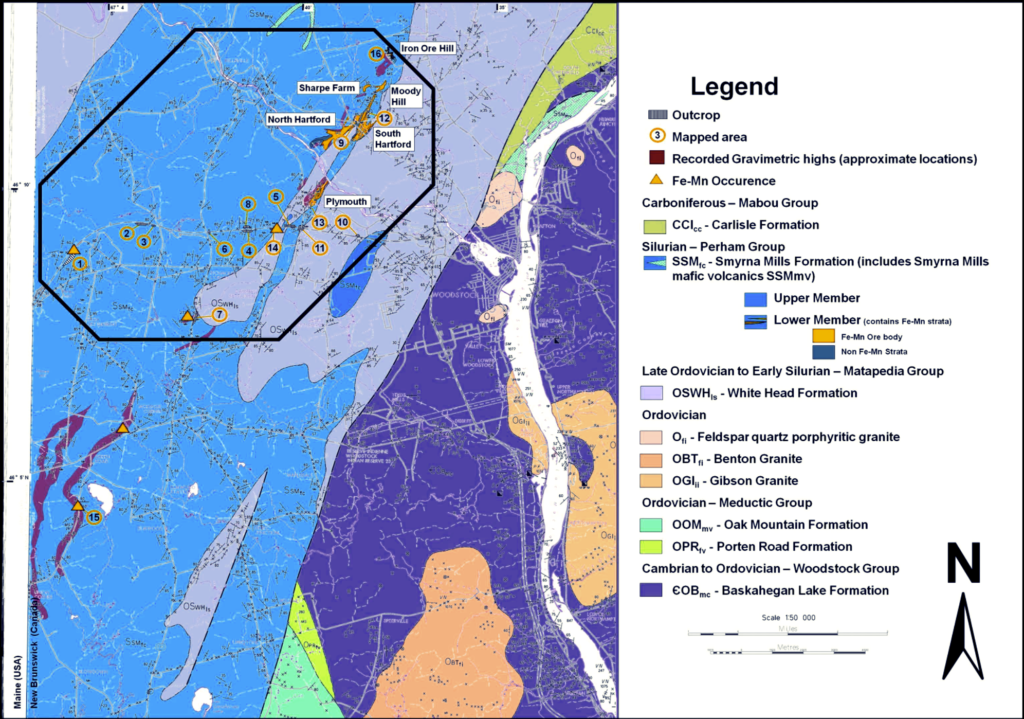

The Canadian Manganese Company (CDMN) has mineral claims on approximately 5875 ha; 232 mineral claims in western New Brunswick (Claim #5472). This area is located approximately 5 km west of the town of Woodstock, NB and 15 km west of the town of Houlton, ME, USA (Ténière et al., 2021). The area staked follows along the historic 1954 gravimetric anomalies done by K.O.J. Sidwell and are associated with the Early Silurian strata of the Smyrna Mills Formation. These gravimetric anomalies are directly on trend with three historically known Fe-Mn deposits (Plymouth, North Hartford, and South Hartford; Figure 1)as well as various localities of Fe-Mn mineralization of unknown size and grade. These manganese deposits are composed of near surface assemblages of Fe-Mn oxide-carbonate and Fe-Mn oxide-silicate-carbonate (Sidwell, 1954; 1957; Smith and Fyffe, 2006; Roberts and Prince, 1990; Way, 2012).

The known Fe-Mn deposits on the northeast end of the CDMN property (i.e. the Plymouth, North Hartford, and South Hartford Deposits) were discovered between 1952 to 1954. Although reports of unmarked Fe-Mn mineralized deposits near the Hartford deposits have been reported back as early as 1848. Previous geological mapping has indicated that these are separate deposits and not one continuous mineralized unit. These deposits lie to the southwest of the historical Woodstock iron mines, operated from 1848 to 1884 by the Woodstock Iron and Charcoal Company, and served as a principal source of iron for plating on British Naval warships (Sidwell, 1957; Potter, 1983).

Figure 1: An overview map of the Canadian Manganese Company property displaying the historical gravimetric anomalies and known Mn deposits near Woodstock, New Brunswick (Canadian Manganese Website, 2022).

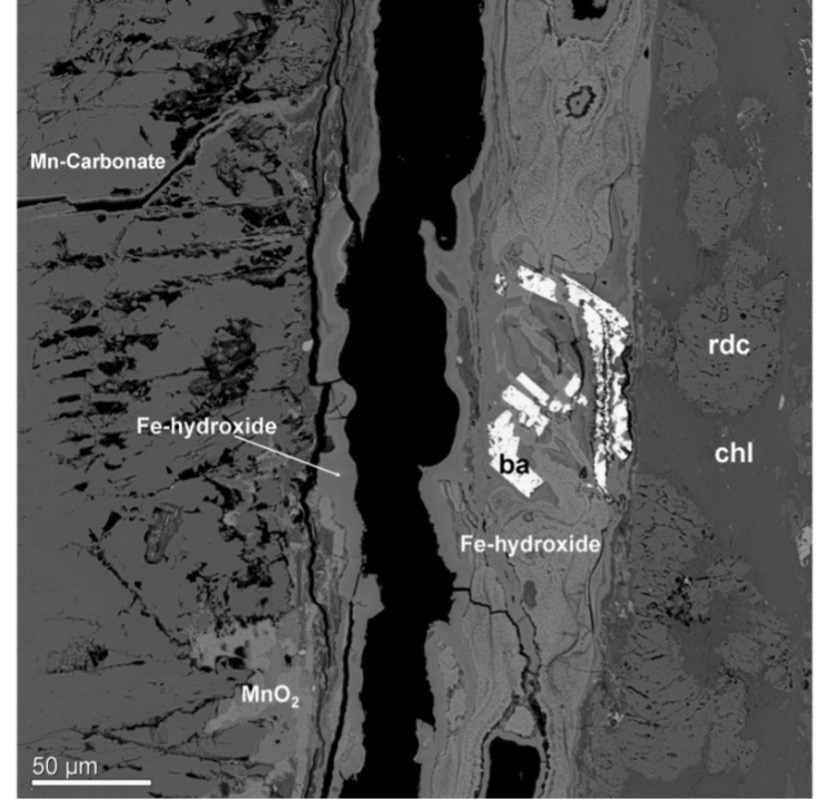

Fe-Mn mineralization of these deposits is often found at surface and is easily distinguished by weathered outcrops of jet-black siltstone with a blocky cleavage and crusted with a surface coating of Fe-Mn hydroxides and oxides as identified by SEM-EDS analysis (Way, 2012; Figures 2 and 3).

Figure 2: Outcrop of a Fe-Mn mineralized section of the North Hartford ore body displaying the Fe-Mn hydroxide coating of the interbedded Fe-Mn oxide and Fe-Mn carbonate facies that are separated by units of green siltstone and surrounded by red siltstone and red chert (hammer for scale; Way 2012).

Figure 3: SEM-BSE image of the surface coating along a fracture plane of Fe-Mn rich laminae present at the North Hartford Deposit. SEM-EDS analysis reveals a coating of interwoven amorphous Fe and Mn hydroxides. The Fe/Mn ratio of the Fe-Mn hydroxide crust often reflects the Fe-Mn concentrations of the bedrock. Sample 9-15-S1 (Way, 2012).

The local geology in the area of interest is composed of two different formations: The Ordovician-Silurian White Head Formation and the conformably overlying Silurian Smyrna Mills Formation (Fyffe, 1982; Ludman, 1988; Smith and Fyffe, 2006; Figure 4). The White Head Formation is a carbonate-rich sandstone that is interpreted to have formed on the continental slope in a subtropical to tropical marine environment within the Iapetus Ocean that was closing (Fyffe, et al., 2011). The seawater at the time, rich in dissolved carbonates, would aid in the overall mineralogy of the Woodstock Deposits.

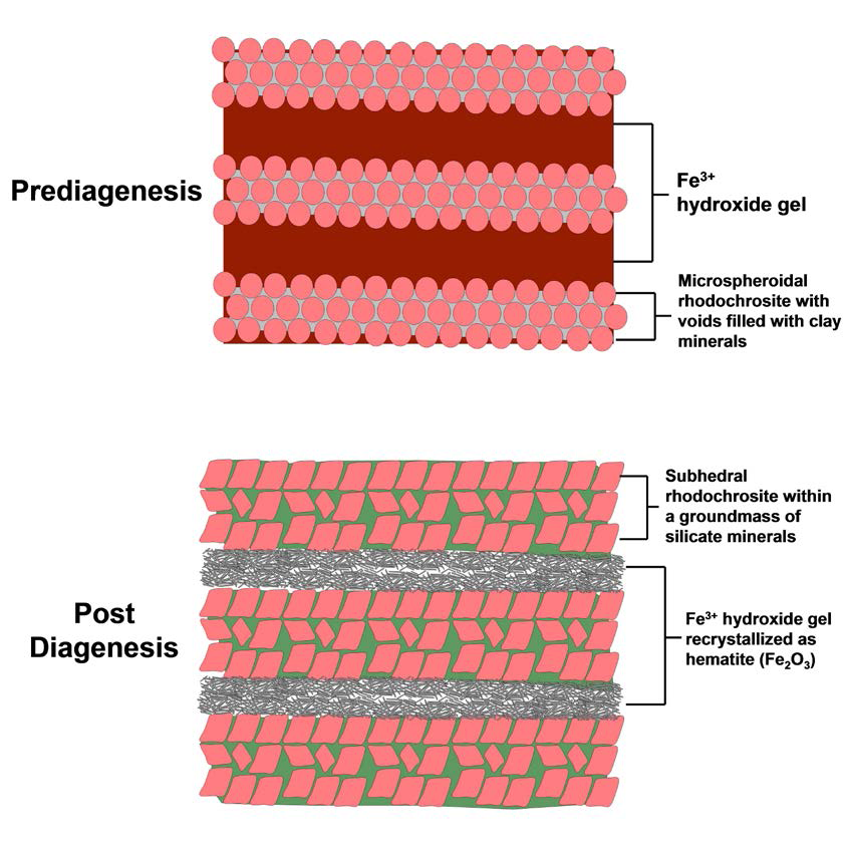

In the Early Silurian, when the Smyrna Mills Formation started forming, the Iapetus Ocean closed and resulted in a shallow marine basin with stagnant ocean currents. Over time the marine basin became anoxic, rich in dissolved iron and manganese, and capped with oxygen-rich seawater. As time progressed, iron precipitated out in the seawater as pyrite (FeS2) and was deposited on the edge of the continental shelf as pyrite-rich mudstone and siltstone. Whereas the manganese remained in the seawater, increasing in concentration. As the basin decreased in depth, both

manganese and iron began to precipitate out as reduced Fe and Mn carbonates resulting in layers Fe and Mn carbonate rich siltstones interbedded with noncalcareous green and grey siltstone. In shallower areas that were near the anoxic-oxic boundary the iron would precipitate out as Fe hydroxides and the Mn would continue to precipitate out as Mn carbonates between layers of noncalcareous maroon to red siltstone. As the layers of sediment from the marine basin were compacted over time they would result in iron and manganese rich siltstones (Way, 2012; Figure 5).

Figure 4: Bedrock geology map of the Woodstock area displaying areas of Fe-Mn mineralization, mapped outcrops, and historical gravimetric anomalies (modified from Sidwell, 1954; Gliders, 1976; Potter, 1983; Roberts and Prince, 1990; Smith and Fyffe, 2006; Way, 2012).

Figure 5: Diagram displaying the changes in composition and structure of the Fe-Mn mineralization before and after diagenesis (Way, 2012).

Proposed

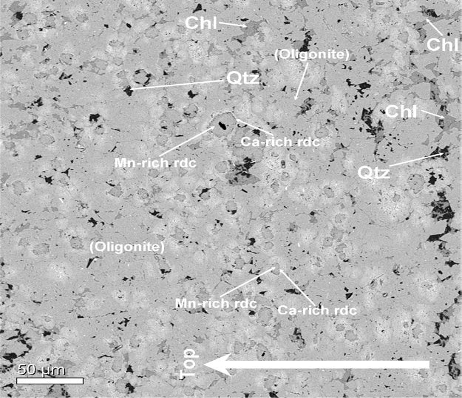

In 2023, CDMN plans to continue a more extensive drilling project on the North Hartford Deposit, detailing the size and shape of the deposit and in turn produce a NI 43-101 Resource Report for North Hartford. Future plans are also in the works to remap the 1954 gravimetric anomalies using modern gravimetric surveying equipment and determine possible drilling targets southwest of the Plymouth and Hartford Deposits (Figure 6). Previous geological mapping has also indicated areas of Fe-Mn mineralization in this area that was identified in SEM-EDS analysis (Way, 2012; Figure 7).

Figure 6: Fe-Mn carbonate-rich outcrop southwest of the Plymouth Deposit near Union Corner, NB. Hammer for scale.

Figure 7: SEM-EDS image of Fe-Mn carbonate rich section near Union Corner, NB displaying oligonite with ghost structures of rhodochrosite (Way, 2012).

References

- Fyffe, L.R., 1982, Geology of Woodstock (sheet 21 J): New Brunswick Department of Natural Resources, Map NR-4.

- Fyffe, L.R., Johnson, S.C., and van Staal, C.R., 2011, A review of Proterozoic to Early Paleozoic lithotectonic terranes in the northeastern Appalachian orogen of New Brunswick, Canada, and their tectonic evolution during Penobscot, Taconic, Salinic, and Acadian orogenesis: Atlantic Geology, v. 47, p. 211 – 248.

- Gliders, R., 1976, Geology of the Woodstock Manganese Claim Group for R.S. Boorman, Assessment Report #470389, Open File Report, New Brunswick Department of Natural Resources, Mineral Development Branch, 17 p.

- Ludman, A., 1988, Revised bedrock geology of central-eastern and southeastern Maine: Maine Geological Survey, Open File Report, 36 p.

- Canadian Manganese Company, 2022, Map of Canadian Manganese Property, URL, <https://canadianmanganese.com/woodstock-project/>, February, 2023.

- Potter, R.R., 1983, The Woodstock iron works Carleton County, New Brunswick: CIM Bulletin, v. 76, p. 81 – 83.

- Roberts, G.C., and Prince, J.D., 1990, Further Characterization of Plymouth Mn Deposit: New Brunswick, Department of Natural Resources and Energy, Minerals, and Energy Division, Open File Report 90-4, 362 p.

- Sidwell, K.O.J., 1954, Preliminary report on the National Management Ltd. Property (N.B. Group 24), Woodstock, N.B.: New Brunswick Department of Natural Resources, Mineral Development Branch, Open file report, 10 p.

- Sidwell, K.O.J., 1957, The Woodstock, N.B., Iron – Manganese Deposits: Transactions of the Canadian Institute of Mining & Metallurgy, v. 50, p. 411 – 416.

- Smith, E.A., and Fyffe, L.R., (Compilers) 2006, Bedrock Geology of the Woodstock Area (NTS 21 J/04) Carleton county, New Brunswick, New Brunswick Department of Natural Resources, Minerals, Policy and Planning Division, Plate 2006 – 5.

- Ténière, P., Harrington, M, Warkentin, D., Elgert., L, 2021, NI 43-101 Battery Hill Project Mineral Resource Estimate Woodstock Area New Brunswick, Canada, 133 p.

- Way, B.C., 2012, Geology and Geochemistry of Sedimentary Ferromanganese Ore Deposits,

Woodstock, New Brunswick, Canada, Unpublished MSc. thesis, University of New Brunswick, Fredericton, 276 p.